Medicare

What is it and How Does it Work?

How it Works

Parts of Medicare

Part A - Hospital

- Part A – Cost

- You usually do not pay a monthly premium for Part A coverage if you or your spouse paid Medicare taxes while working for a certain amount of time. This is sometimes called premium-free Part A. If you are not eligible for premium free Part A, you may be able to buy Part A.

- Part A Coverage

- Part A (Hospital Insurance) helps cover:

- Inpatient care in a hospital

- Inpatient care in a skilled nursing facility (not custodial or long-term care)

- Hospice care

- Home health care

- Inpatient care in a religious nonmedical health care institution

Part B – Medical

- Part B Costs

- The standard Part B premium amount in 2020 is $144.60. Most people pay the standard Part B premium amount.

- If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you will pay the standard premium amount and an Income Related Monthly Adjustment Amount, also known as IRMAA.

- Part B Coverage

- Medicare Part B (Medical Insurance) helps cover medically necessary doctors’ services, outpatient care, home health services, durable medical equipment, mental health services, and other medical services. Part B also covers many preventive services.

Part C – Medicare Advantage Plan

- A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance) coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage (Part D). In most cases, you will need to use health care providers who participate in the plan’s network. However, many plans offer out of network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because you will need it if you ever switch back to Original Medicare.

- PPO Plans

- PPO plans have network doctors, other health care providers, and hospitals, but you can also use out-of-network providers for covered services, usually for a higher cost. You are always covered for emergency and urgent care.

- HMO Plans

- You generally must get your care and services from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). In some HMO plans, you may be able to go out-of-network for certain services, usually for a higher cost. This is called an HMO with a point-of-service (POS) option.

- MA only /Veteran plans

- Medicare Advantage Plans that are typically HMO or PPO networks but do not included prescription drug coverage

- Special Needs Plans- Dual eligible/Chronic conditions

- A Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and drug formularies to best meet the specific needs of the groups they serve.

These groups are eligible to enroll in a SNP:

- People who live in certain institutions (like nursing homes) or who require nursing care at home (also called an Institutional SNP or I-SNP).

- People who are eligible for both Medicare and Medicaid (also called a Dual Eligible SNP or D-SNP).

- People who have specific severe or disabling chronic conditions (like diabetes, End-Stage Renal Disease, HIV/AIDS, chronic heart failure, or dementia) (also called a Chronic condition SNP or C-SNP). Plans may further limit membership

Part D – Prescription Drug Coverage

- Medicare prescription drug coverage is an optional benefit. Medicare drug coverage is offered to everyone with Medicare. Even if you do not use prescription drugs now, you should consider joining a Medicare drug plan. If you decide not to join a Medicare drug plan when you’re first eligible, and you don’t have other creditable prescription drug coverage or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you will pay this penalty for as long as you have Medicare prescription drug coverage.

Supplement Plans

- What are supplements

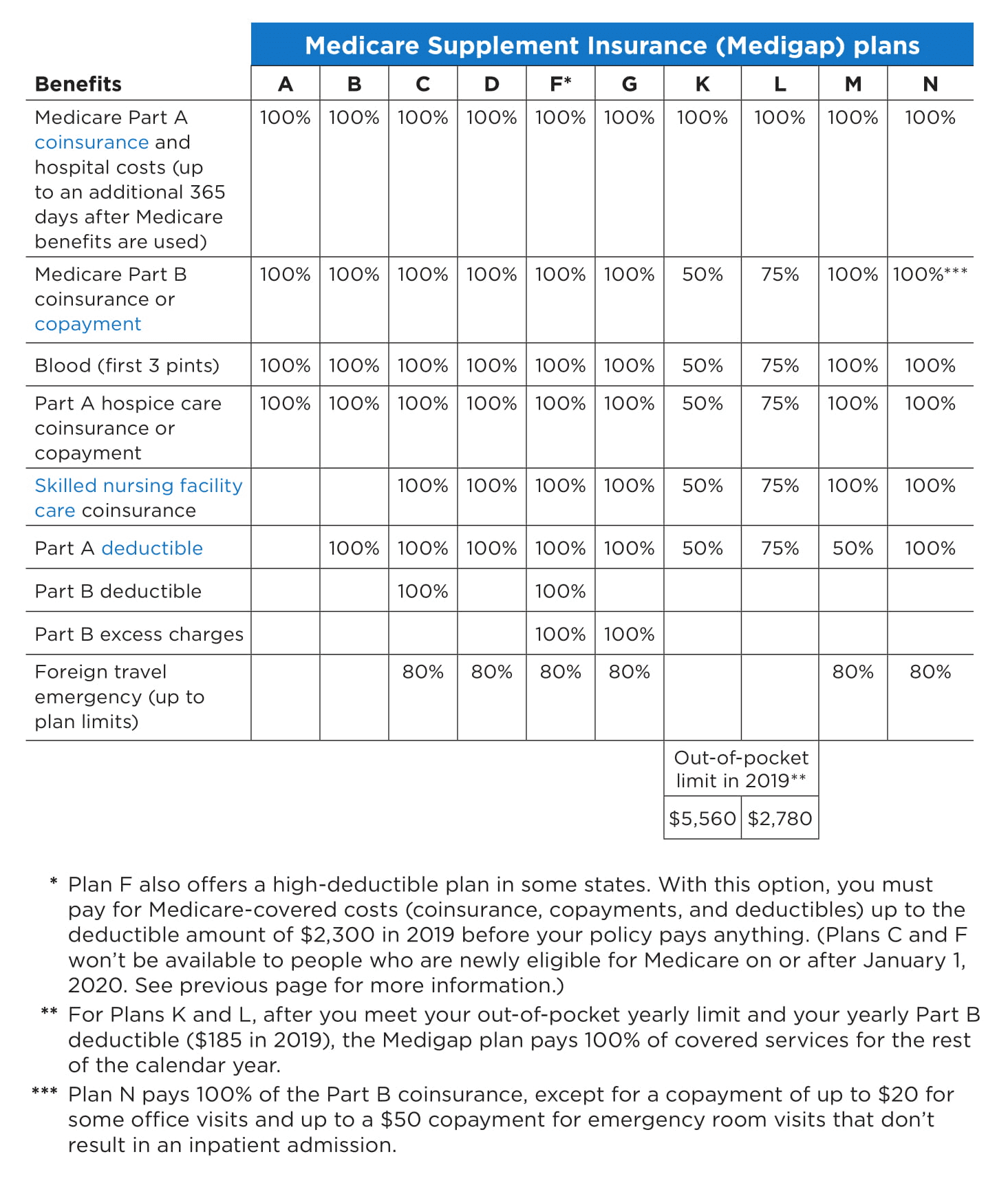

- Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. Medicare Supplement Insurance policies, sold by private companies, can help pay some of the remaining health care costs for covered services and supplies, like copayments, coinsurance, and deductibles. Medicare Supplement Insurance policies are also called Medigap policies.

- Some Medigap policies also offer coverage for services that Original Medicare does not cover, like medical care when you travel outside the U.S. Generally, Medigap policies do not cover long-term care (like care in a nursing home), vision or dental care, hearing aids, eyeglasses, or private-duty nursing.

- Medigap policies are standardized

- Every Medigap policy must follow federal and state laws designed to protect you, and they must be clearly identified as “Medicare Supplement Insurance.” Insurance companies can sell you only a “standardized” policy identified in most states by letters A through D, F, G, and K through N. All policies offer the same basic benefits, but some offer additional benefits so you can choose which one meets your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way.

- Changes in what plans you can get

- Starting January 1, 2020, Medigap plans sold to people who are new to Medicare will not be allowed to cover the Part B deductible. Because of this, Plans C and F will not be available to people who are newly eligible for Medicare on or after January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you will be able to keep your plan. If you were eligible for Medicare before January 1, 2020, but not yet enrolled, you may be able to buy one of these plans.

- Different plans (list of letters)

- Plans A-N

- List break down (need to add)

- Plans A-N

Medicare eligibility

- Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

- You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

- You are eligible to receive Social Security or Railroad benefits, but you have not yet filed for them.

- You or your spouse had Medicare-covered government employment.

Medicare Enrollment Periods

Initial Enrollment Period

- You can first sign up for Part A and/or Part B during the 7-month period that begins 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

- If you sign up for Part A and/or Part B during the first 3 months of your Initial Enrollment Period, in most cases, your coverage starts the first day of your birthday month. However, if your birthday is on the first day of the month, your coverage will start the first day of the prior month.

- If you enroll in Part A (that you have to pay for) and/or Part B the month you turn 65 or during the last 3 months of your Initial Enrollment Period, the start date for your Part B coverage will be delayed.

Special Enrollment Period

After your Initial Enrollment Period is over, you may have a chance to sign up for Medicare during a Special Enrollment Period. If you did not sign up for Part B (or Part A if you have to buy it) when you were first eligible because you are covered under a group health plan based on current employment (your own, a spouse’s, or a family member’s (if you have a disability), you can sign up for Part A and/or Part B:

- Anytime you are still covered by the group health plan

- During the 8-month period that begins the month after the employment ends or the coverage ends, whichever happens first

Usually, you do not pay a late enrollment penalty if you sign up during a Special Enrollment Period. This Special Enrollment Period does not apply to people who are eligible for Medicare based on End-Stage Renal Disease (ESRD). It also does not apply if you are still in your Initial Enrollment Period.

Note: If you have a disability, and the group health plan coverage is based on the current employment of a family member (other than a spouse), the employer offering the group health plan must have 100 or more employees for you to get a Special Enrollment Period.

General Enrollment Period

If you did not sign up for Part A (if you have to buy it) and/or Part B (for which you must pay premiums) during your Initial Enrollment Period, and you do not qualify for a Special Enrollment Period; you can sign up between January 1–March 31 each year. Your coverage will not start until July 1 of that year, and you may have to pay a higher Part A and/or Part B premium for late enrollment.

Dental, Vision & Hearing - Quote Engine

http://www.1enrollment.com/564520

TESTIMONIALS

What People Are Saying

Chris is an awesome and knowledgeable insurance agent. He was so good at explaining all the different options and figuring out what was best for us. He has a vast knowledge of the Medicare Maze which took a huge burden off our shoulders. He is tireless in his attempts to get us what we need. He is someone we can continue to rely on for additional help. We will highly recommend him to all our friends and anyone we know entering the Medicare world.

Chris is very knowledge and has many carriers to access to get you the best price and coverage for your individual Medicare supplements.

I have known Chris for many years and he is very good at what he does. I would highly recommend him for your Medicare needs.